Owner's Earnings: The True Cash Flow

Michael Burry's methodology for calculating what shareholders actually earn — not what Wall Street tells you

10 min read

Wall Street has a dirty secret: they systematically overstate company earnings by treating stock-based compensation (SBC) as a "non-cash" expense that should be added back to earnings.

What Wall Street Does

- • Takes GAAP Net Income

- • Adds back SBC expense as "non-cash"

- • Reports inflated "Adjusted Earnings"

- • Ignores the real cost of dilution

The Reality

- • SBC creates real dilution

- • Companies spend real cash on buybacks

- • RSU tax withholdings are real cash outflows

- • True cost is often 5-10x the GAAP expense

The Hidden Truth

Owner's Earnings is a concept developed by Michael Burry (of "The Big Short" fame) to calculate the true cash flow available to shareholders after accounting for the real cost of stock-based compensation.

"The TRUE cost of SBC is not the GAAP expense — it's the actual cash spent to offset dilution through buybacks and RSU tax withholdings."

The Key Insight

When a company grants stock options or RSUs to employees, it creates dilution. To prevent shareholders from being diluted, companies must buy back shares. The cash spent on these buybacks (plus RSU tax withholdings) is the TRUE cost of SBC — not the accounting expense.

Owner's Earnings Formula

Add Back (+)

- NI = Net Income (GAAP)

The starting point — reported earnings

- SBC = Stock-Based Compensation expense

Non-cash accounting expense (add it back)

Subtract (−)

- Buybacks = Cash spent repurchasing shares

Real cash outflow to offset dilution

- RSU Tax = RSU tax withholding payments

Hidden cash outflow in Financing Activities

Why Add Back SBC?

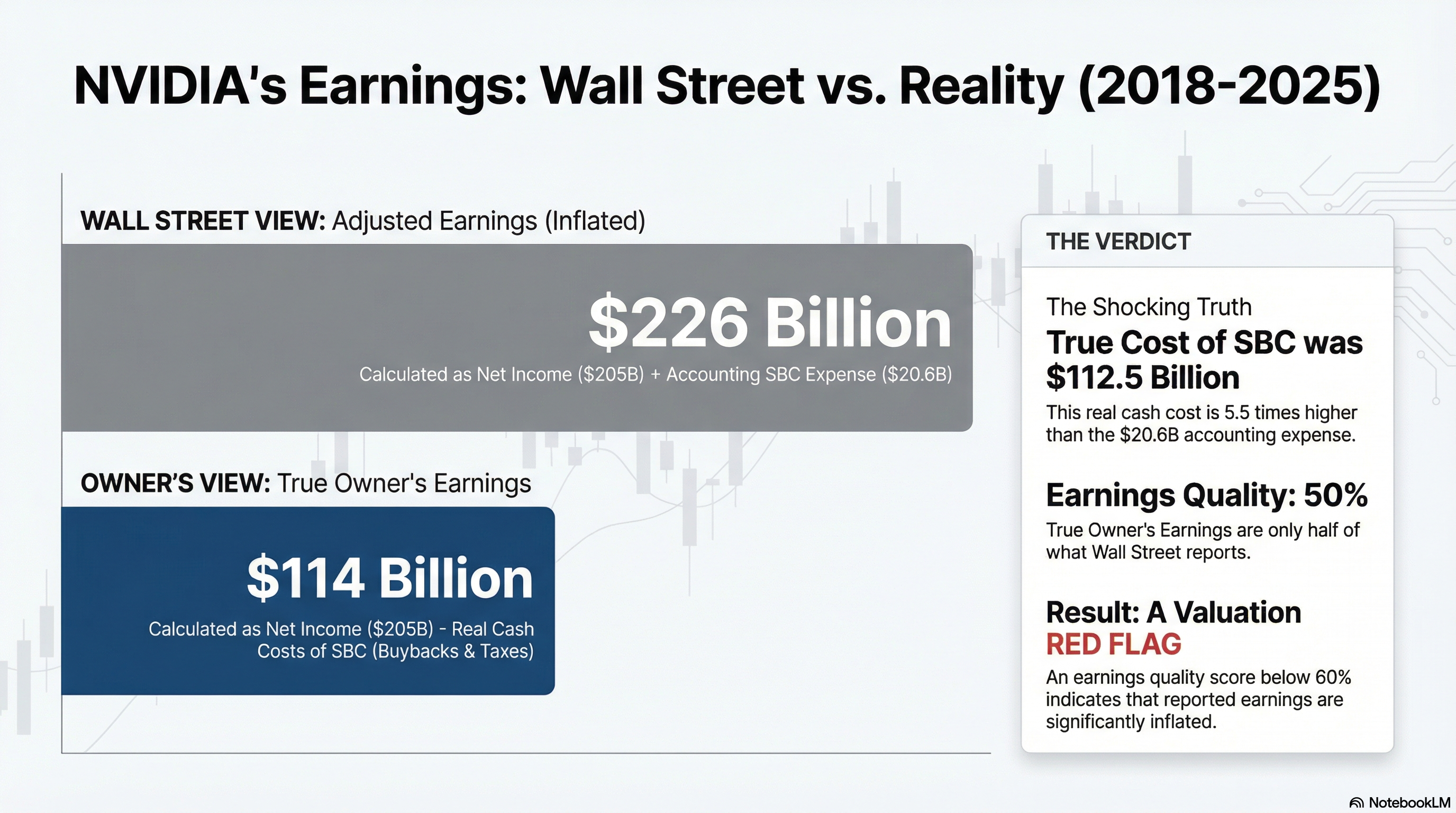

Let's look at NVIDIA — one of the most valuable companies in the world — and see how Wall Street's earnings compare to TRUE Owner's Earnings.

| Metric | Amount |

|---|---|

| GAAP Net Income | $205B |

| + GAAP SBC (add-back) | +$20.6B |

| Wall Street "Adjusted" Earnings | $226B |

| − Actual Buybacks | −$91B |

| − RSU Tax Withholdings | −$21.5B |

| TRUE Owner's Earnings | $114B |

Earnings Quality

50%

OE / Wall Street

GAAP SBC Expense

$20.6B

Accounting entry

TRUE SBC Cost

$112.5B

5.5x higher!

The Shocking Truth

The Earnings Quality metric is a simple ratio that tells you how much of Wall Street's reported earnings are actually real:

Earnings Quality Formula

Good

SBC cost is reasonable relative to earnings

Caution

Significant SBC dilution — investigate further

Red Flag

Wall Street earnings are significantly inflated

Companies with Low Earnings Quality

Many high-growth tech companies have earnings quality below 60%:

- • NVIDIA: ~50% (as shown above)

- • Tesla: Dilutes shareholders at ~3.6% annually

- • Palantir: Often has NO earnings after TRUE SBC cost

- • Amazon: Gave employees $233B in stock (more than $220B GAAP earnings since 2018)

BurryDCF pulls data directly from SEC EDGAR XBRL filings (10-K and 10-Q reports). Here are the exact fields used:

| Component | SEC XBRL Field |

|---|---|

| Net Income | us-gaap:NetIncomeLoss |

| SBC Expense | us-gaap:ShareBasedCompensation |

| Buybacks | us-gaap:PaymentsForRepurchaseOfCommonStock |

| RSU Tax | us-gaap:PaymentsRelatedToTaxWithholdingForShareBasedCompensation |

Full Transparency

The Hidden RSU Tax

RSU tax withholdings are often buried in the "Financing Activities" section of the cash flow statement. This is a real cash outflow that most analysts miss. When employees vest RSUs, companies withhold shares and pay cash to the IRS on their behalf — this is a real cost of SBC.

Owner's Earnings is the CF₁ (cash flow) input in both the Gordon Growth Model and Burry's dilution-aware formula. Using the wrong cash flow leads to dramatically wrong valuations.

Using Wall Street Earnings

If you use Wall Street's inflated "Adjusted Earnings" as CF₁, you'll calculate a fair value that's 50-100% too high for companies with significant SBC programs.

Using Owner's Earnings

Using TRUE Owner's Earnings gives you a realistic fair value that accounts for the real cost of SBC. This is what shareholders actually receive.

Connection to Discount Rate

Remember from our CAPM article: the discount rate (d) determines how much future cash flows are worth today. But if your cash flow (CF₁) is wrong, even a perfect discount rate won't save you.

The Complete Picture

- • Correct CF₁: Owner's Earnings (this article)

- • Correct d: CAPM discount rate (previous article)

- • Dilution adjustment: Burry's formula (next article)

CAPM Explained

Understand how to calculate the discount rate using the Capital Asset Pricing Model.

← Read previousBurry's Dilution-Aware DCF Guide

Put it all together: learn how to adjust the Gordon Growth Model for stock dilution.

Read next →Ready to see true earnings?

Try BurryDCF free — see Owner's Earnings for any stock with full SEC data provenance.