CAPM Explained: Understanding Discount Rates

The Capital Asset Pricing Model is the foundation for calculating the required rate of return in stock valuation

8 min read

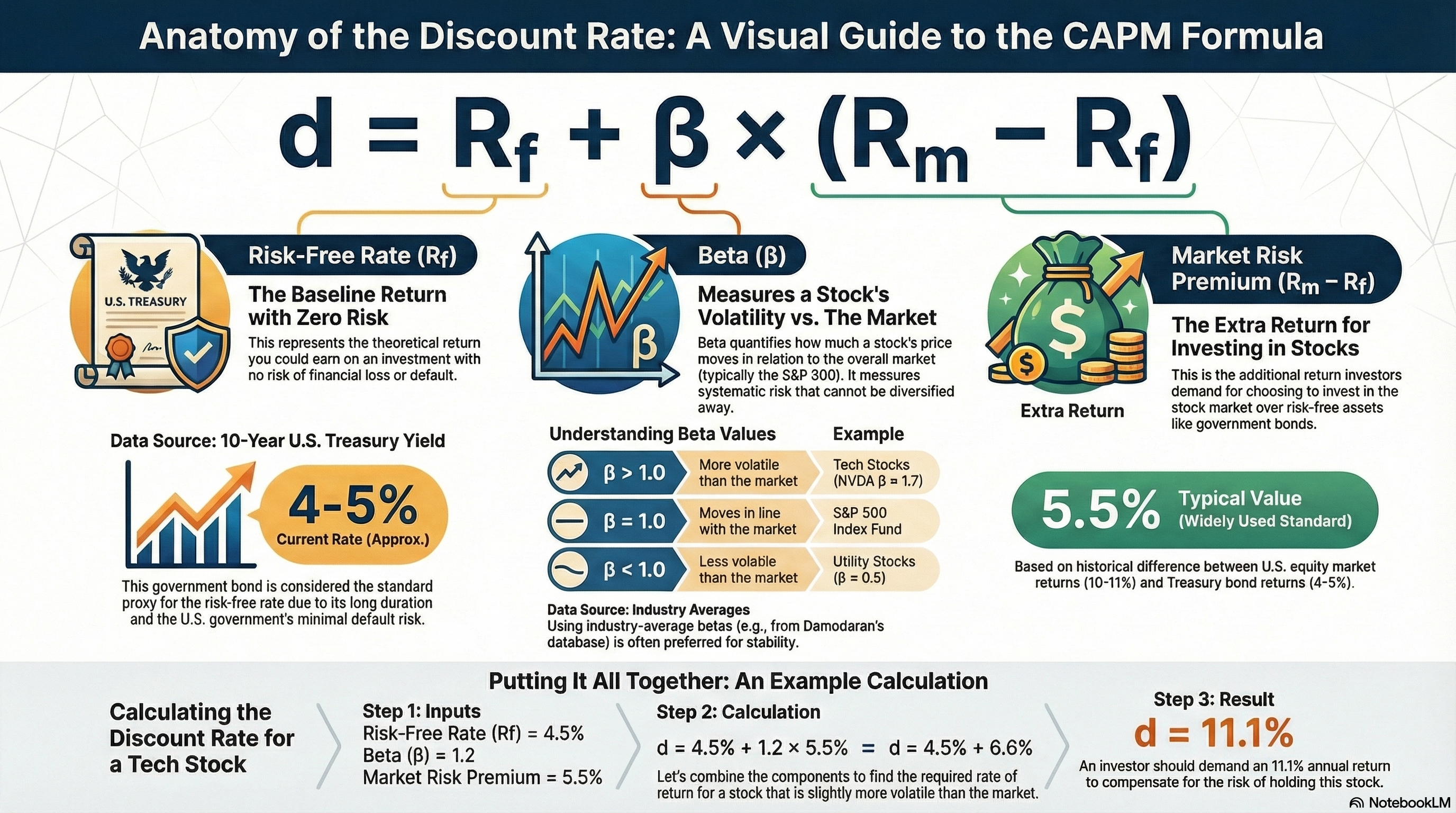

The Capital Asset Pricing Model (CAPM) is a financial model that calculates the expected return an investor should demand for holding a risky asset. In stock valuation, this expected return becomes the discount rate — the rate used to convert future cash flows into present value.

Why Does the Discount Rate Matter?

The discount rate is arguably the most important input in any DCF valuation. A higher discount rate means future cash flows are worth less today, resulting in a lower fair value. A lower discount rate means the opposite — higher fair value.

CAPM answers a fundamental question: "Given the risk of this stock, what return should I expect to compensate me for that risk?"

The Formula

Variables

- d = Discount rate (required return)

- Rf = Risk-free rate

- β = Beta (systematic risk)

- Rm = Expected market return

- Rm − Rf = Market risk premium

Intuition

Start with the risk-free rate (what you'd earn with zero risk), then add a premium for taking on market risk. The premium is scaled by beta — how much the stock moves with the market.

The risk-free rate represents the return you could earn on an investment with zero default risk. In practice, this is typically the yield on government bonds, specifically the 10-Year U.S. Treasury yield.

Why 10-Year Treasury?

- • U.S. government bonds are considered "risk-free" (no default risk)

- • 10-year duration matches typical investment horizons

- • Highly liquid and widely quoted

- • Current rate: approximately 4-5% (as of 2025)

Important Note

Beta measures how much a stock's price moves relative to the overall market (typically the S&P 500). It quantifies systematic risk — the risk that cannot be diversified away.

| Beta Value | Interpretation | Example |

|---|---|---|

| β = 1.0 | Moves with the market | S&P 500 index fund |

| β > 1.0 | More volatile than market | Tech stocks (NVDA β ≈ 1.7) |

| β < 1.0 | Less volatile than market | Utilities (β ≈ 0.5) |

| β < 0 | Moves opposite to market | Gold, some hedge funds |

How Beta is Calculated

Beta is calculated by regressing the stock's historical returns against market returns. BurryDCF uses industry-average betas from Damodaran's database, which are more stable than individual stock betas.

Let's calculate the discount rate for a tech stock with the following inputs:

Inputs

- • Risk-free rate (Rf) = 4.5% (10-Year Treasury)

- • Beta (β) = 1.2 (slightly more volatile than market)

- • Market risk premium = 5.5%

Calculation

d = Rf + β × (Rm − Rf)

d = 4.5% + 1.2 × 5.5%

d = 4.5% + 6.6%

d = 11.1%

This means an investor should require an 11.1% annual return to compensate for the risk of holding this stock. This rate is then used to discount future cash flows in the DCF model.

When you enter a stock ticker in BurryDCF, the app automatically calculates the discount rate using CAPM:

Fetch Risk-Free Rate

Current 10-Year Treasury yield from FRED API (daily cached)

Look Up Industry Beta

Industry-average beta from Damodaran's database (more stable than individual betas)

Apply CAPM Formula

Calculate discount rate with 5.5% market risk premium (adjustable)

Use in Valuation

The discount rate becomes "d" in both the Gordon Growth Model and Burry's dilution-aware formula

Pro Tip

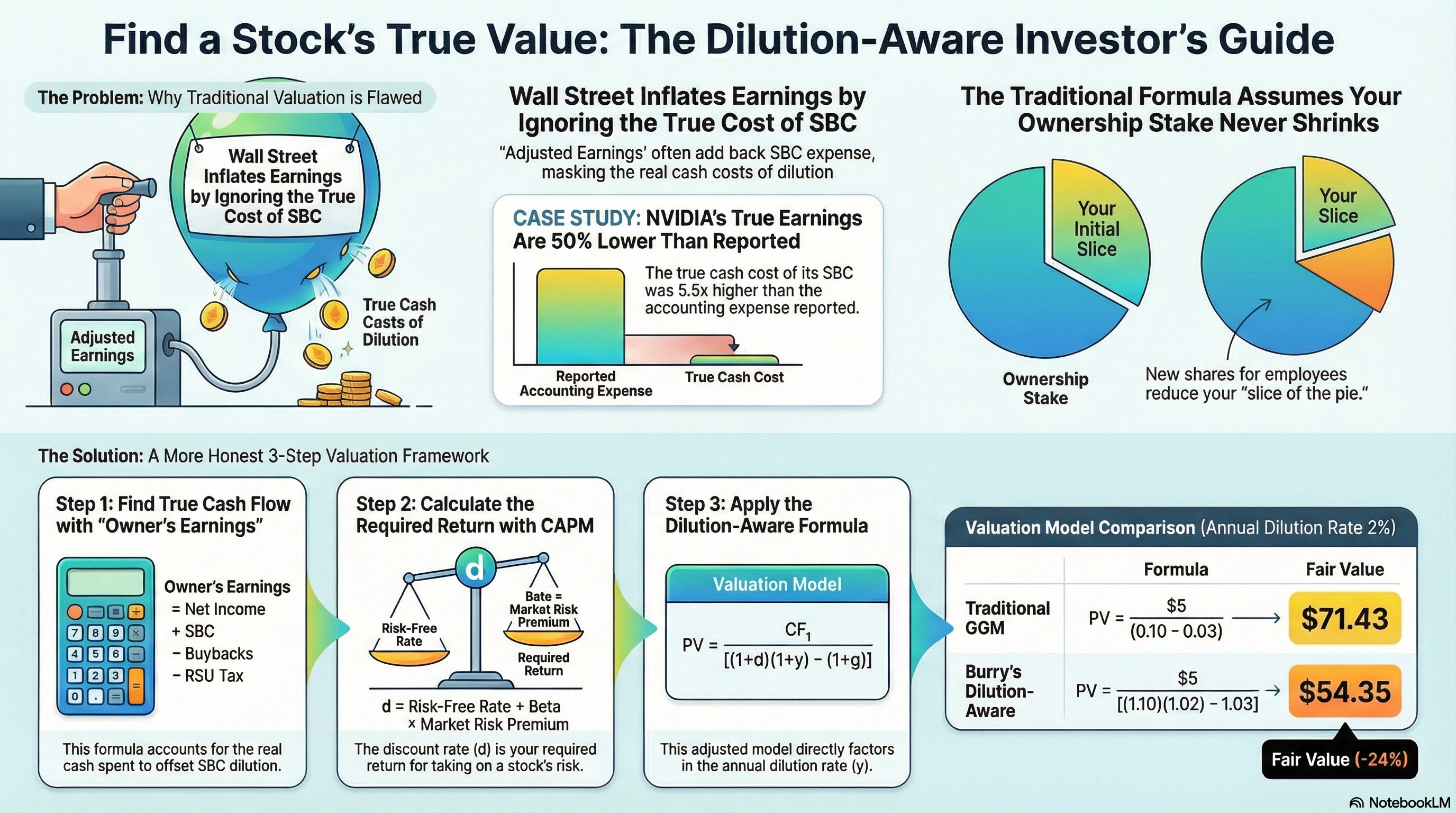

Owner's Earnings: The True Cash Flow

Learn how to calculate the true cash flow available to shareholders using Michael Burry's methodology.

Read next →Burry's Dilution-Aware DCF Guide

Put it all together: learn how to adjust the Gordon Growth Model for stock dilution.

Read more →Ready to calculate fair value?

Try BurryDCF free — see CAPM in action with real stock data.