Burry's Dilution-Aware DCF Guide

The complete guide to adjusting the Gordon Growth Model for stock-based compensation dilution

12 min read

Prerequisites

- • CAPM Explained — Understanding the discount rate (d)

- • Owner's Earnings — Calculating true cash flow (CF₁)

The Gordon Growth Model (GGM) is the classic formula for valuing a perpetually growing stream of cash flows. It's simple, elegant, and widely used — but it has a critical flaw.

Traditional GGM Formula

Variables

- PV = Present Value (fair value per share)

- CF₁ = Next year's cash flow per share

- d = Discount rate (from CAPM)

- g = Perpetual growth rate

Key Constraint

d > gThe discount rate must exceed the growth rate, otherwise the formula produces negative or infinite values.

Example

A company with $5 per share cash flow, 10% discount rate, and 3% growth:

PV = $5 / (0.10 − 0.03) = $5 / 0.07 = $71.43The traditional GGM assumes your ownership percentage stays constant forever. But in reality, companies continuously issue new shares through stock-based compensation, diluting existing shareholders.

The Pie Analogy

Imagine you own 1% of a pie. The pie is growing at 5% per year (that's g). But the company is also giving away 2% of the pie to employees each year (that's y). Your slice is growing slower than you think — or even shrinking!

The Hidden Cost

Traditional GGM Assumes

- • Share count stays constant

- • Your ownership % never changes

- • All growth accrues to you

Reality

- • Share count grows 1-5% annually

- • Your ownership % shrinks

- • Some growth goes to new shareholders

Michael Burry's insight was to modify the GGM to account for perpetual dilution. When a company dilutes shareholders at rate y each year, the effective growth of per-share value is reduced.

Burry's Dilution-Aware Formula

Mathematical Derivation

The denominator can be expanded:

(1+d)(1+y) − (1+g) = 1 + d + y + dy − 1 − g = d + y + dy − gFor small values of d and y, the cross-term dy is negligible:

≈ d + y − gThis shows that dilution (y) effectively adds to the discount rate, reducing the present value.

Key Constraint

(1+d)(1+y) > (1+g)The combined effect of discount rate and dilution must exceed growth. If growth is too high relative to d+y, the model doesn't converge.

CF₁ — Cash Flow (Owner's Earnings)

The expected cash flow per share next year. BurryDCF uses Owner's Earnings — the TRUE cash flow after accounting for the real cost of SBC.

d — Discount Rate (CAPM)

The required rate of return, calculated using CAPM. Typically 8-15% for most stocks.

y — Dilution Rate

The annual rate at which share count is growing (dilution) or shrinking (buybacks).

- • Positive y: Dilution (shares increasing) — bad for shareholders

- • Negative y: Net buybacks (shares decreasing) — good for shareholders

- • Typical range: -5% to +5%

g — Growth Rate

The perpetual growth rate of cash flows. BurryDCF calculates this from historical Owner's Earnings growth (CAGR).

- • Should not exceed long-term GDP growth (~2-3%) for mature companies

- • High-growth companies may have higher g, but it will eventually decline

- • BurryDCF caps g at 30% to prevent unrealistic valuations

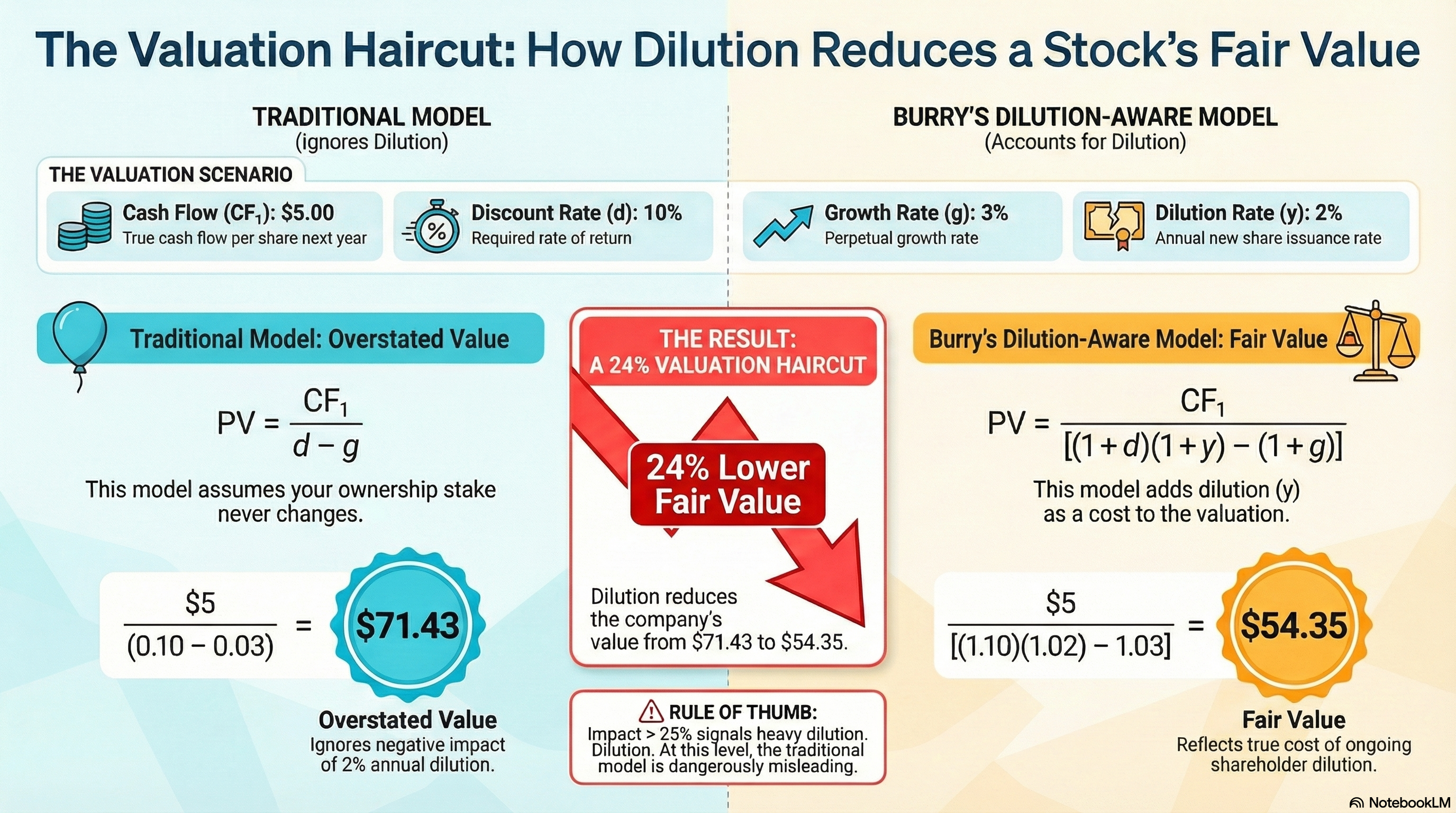

Let's compare both models using the same inputs to see the impact of dilution:

Inputs

- • CF₁ = $5.00 per share (Owner's Earnings)

- • d = 10% (discount rate from CAPM)

- • g = 3% (perpetual growth rate)

- • y = 2% (annual dilution rate)

Traditional GGM

PV = CF₁ / (d − g)

PV = $5 / (0.10 − 0.03)

PV = $5 / 0.07

PV = $71.43

Burry's Model

PV = CF₁ / [(1+d)(1+y) − (1+g)]

PV = $5 / [(1.10)(1.02) − 1.03]

PV = $5 / [1.122 − 1.03]

PV = $5 / 0.092

PV = $54.35

The Difference

The valuation haircut is the percentage difference between the traditional GGM fair value and Burry's dilution-aware fair value:

Haircut Formula

Minimal Impact

Low dilution or net buybacks — traditional GGM is reasonable

Moderate Impact

Significant dilution — use Burry's model for better accuracy

Major Impact

Heavy dilution — traditional GGM is dangerously misleading

Negative Haircut?

If a company has net buybacks (negative y), the Burry model will produce a higher fair value than traditional GGM. This is correct — buybacks increase per-share value by reducing share count.

The dilution-aware model is most valuable for companies with significant stock-based compensation programs:

Best For

- • High-growth tech companies (NVDA, TSLA, META)

- • Companies with heavy SBC programs

- • Startups and growth stocks

- • Any company with >1% annual dilution

Less Critical For

- • Mature dividend-paying companies

- • Companies with consistent buybacks

- • Low-SBC industries (utilities, REITs)

- • Companies with stable share counts

Pro Tip

Model Limitations

- • Perpetuity assumption: Real companies don't grow forever at a constant rate

- • Historical dilution: Past dilution may not predict future dilution

- • Growth rate uncertainty: g is inherently difficult to estimate

- • One input among many: Use alongside other valuation methods

CAPM Explained

Understand how to calculate the discount rate (d) using the Capital Asset Pricing Model.

← Read articleOwner's Earnings

Learn how to calculate true cash flow (CF₁) using Michael Burry's methodology.

← Read articleReady to calculate fair value?

Try BurryDCF free — see both GGM and dilution-aware valuations for any stock.